How to Position Your Program to Investors: Leveraging FDA Feedback to Communicate Risk and Boost Confidence

When pitching to investors, a sponsor is not just selling them on the product; it is also promoting its ability to develop that product. Investors want to know the risks involved with the program, but they are also evaluating the sponsor as a risk factor of its own.

Investing in emerging biopharma companies is a dangerous proposition, especially in Seed or Series A rounds, so savvy early-stage investors will seek their best risk-adjusted return on investment. Investors want to know how much the program will cost, how long until the planned exit, what the risks are, and how the sponsor plans to minimize those risks. If an early-stage company has not identified the knowable risks associated with its program and outlined a plan to address them, the investment proposition will be less attractive, and the credibility of the management team may come into question.

On the other hand, conveying a well-defined program to potential investors and proactively addressing their questions can boost their confidence in the sponsor, minimize its management team as a risk factor, and ensure that investors have confidence in their investment.

Previously in this blog, we described how sponsors can set themselves up for an effective pre-IND meeting with the FDA and what a truly successful meeting looks like. Many sponsors use the completion of that initial FDA meeting as a springboard to raise external capital, as the outcome of the pre-IND meeting can be a useful fundraising tool. The trick is figuring out how to translate the FDA’s feedback into a compelling investor pitch.

Outline the program

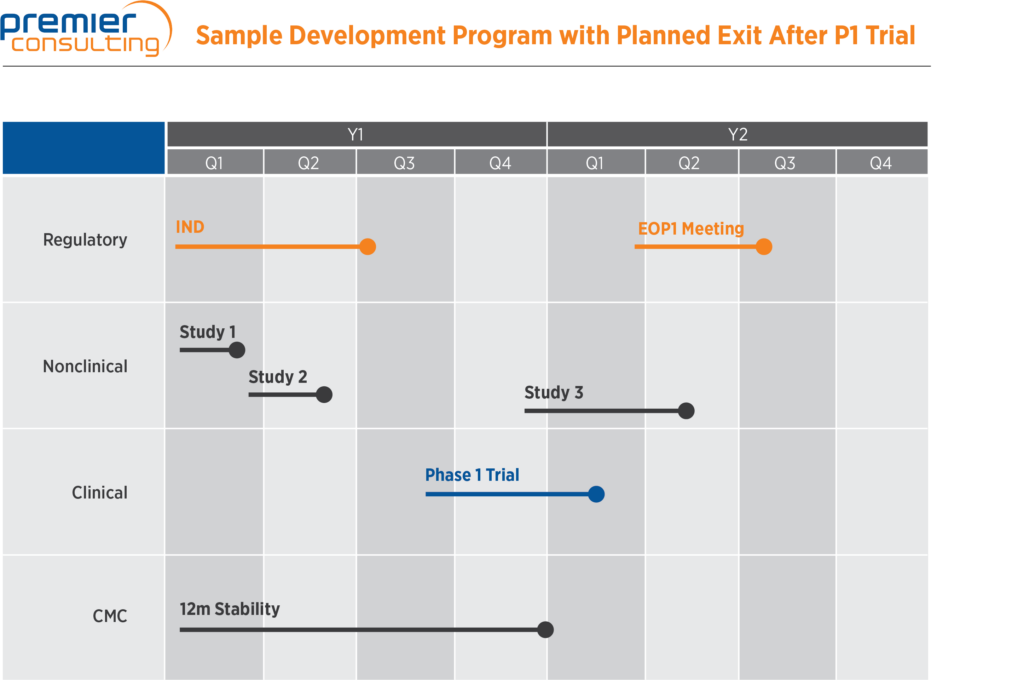

After executing a well-planned pre-IND meeting, a sponsor should have a detailed picture of the entire development program for its product. This will include any nonclinical studies; clinical trials; chemistry, manufacturing, and controls activities; and additional regulatory milestones. A sponsor should outline the program for investors and clearly identify the path to potential value-creating regulatory and development milestones.

Which parts of the program a sponsor presents should depend on the fundraising strategy and length of the program. If only a single trial is needed and the sponsor is looking to raise funds for all development activities needed to file an NDA, it should lay out the whole program. Conversely, if the plan is to raise funds in stages, the sponsor should lay out the pieces needed to achieve the next milestone.

It is best to lay out these pieces of the development plan in an easily readable visual format for investors. A visual framework that describes the full scope of the expected development program (while acknowledging potential downstream changes) level-sets early investors’ expectations and allows the sponsor to define the link between the development program and the planned commercial strategy.

Above is an example of a development program that a sponsor is planning to exit after a Phase 1 clinical trial. Each piece of the program for which the sponsor is seeking capital is clearly laid out, and an investor can easily read this and understand what the proposed development program entails.

Do not gloss over negative feedback

The FDA sometimes offers feedback that points out risks or gaps in a sponsor’s strategy. However, investors know that drug development is risky business. Negative comments from the agency should not be ignored or hidden in a pitch deck. Instead, a sponsor should describe the identified risk, explain how it could impact the program, and detail the mitigation plan. Acknowledging the risks and discussing how to minimize them builds potential investors’ confidence in the program and in the sponsor’s ability to successfully develop the product.

Here are some examples of how it is possible to present negative FDA feedback in a pitch:

“The agency has said that our formulation includes an unqualified excipient. We plan to run a short study to collect data on the safety of this excipient that we can include in our IND application. This means that the earliest we can start our clinical trial is 6 months from now.”

“The FDA signaled that our supportive nonclinical safety data is insufficient. If we move straight into an IND, there is a risk that we could get placed on a clinical hold. We feel it would be best to run additional nonclinical studies prior to submitting the IND. With the addition of these studies, we are targeting Q1 to open the IND.”

Highlight the positives

A sponsor should put a spotlight on anything the agency says that decreases the size of the overall program. Investors will be excited to hear about a program that may be shorter in duration, be lower in cost, or have some other special designation.

“The FDA agreed that our product falls under the 505(b)(2) pathway. The agency has found our proposed abbreviated clinical program, consisting of a single Phase 1 trial, sufficient to support an NDA. We will not have to do large Phase 2 or 3 trials.”

“The agency deemed our justification for orphan drug designation (ODD) reasonable and requested that we submit an ODD application. If we receive ODD, we will get a range of perks including a waived PDUFA fee on our NDA as well as exclusivity.”

Premier Consulting has extensive experience representing sponsors in FDA meetings to gain valuable insights on their planned development programs. Contact us to find out how we can help you obtain meaningful feedback that will give investors confidence in you and in your program.