Abuse-Deterrent Opioids – The Insider’s Guide to Innovation and Exclusivity in a Changing Regulatory Landscape

As discussed in a previous blog post (here), the 505(b)(2) development pathway provides a flexible path for developers of new abuse-deterrent formulations. The FDA has shown significant motivation and flexibility in its drive to work with innovators to address the ongoing opioid crisis in the US. Along these lines, recent developments in the FDA’s stance on granting exclusivity to new and differentiated abuse-deterrence products have been summarized and interpreted at the FDA Law Blog (here, here, and here).

It was recently noted that a newly proposed bill would modify the rules for exclusivity for products with abuse deterrence claims. Given this changing regulatory landscape for abuse-deterrence products, the question is “how does this impact the potential for new innovation in abuse deterrent opioid products?” In short, all signs suggest that the FDA will work with innovators of new abuse-deterrence technologies to support progress in their development, potentially at the expense of their predecessors.

Given the remaining unknowns in the requirements for developing generic abuse-deterrent formulations, the 505(b)(2) pathway remains the most viable path forward for most companies looking to get into this market. That said, it would appear the bar is rising for requirements to support approval. The low-hanging fruit is fast being plucked. Development of products that could be marketed based solely on a limited or focused development program and with little or no consideration of other products in the space are becoming few and far-between. The next wave of anti-abuse opioids need to be innovative.

Example of the Current Market

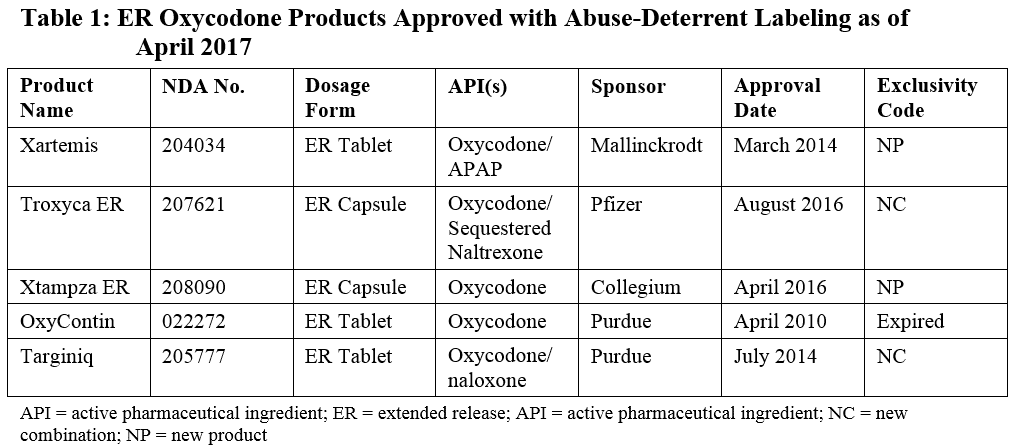

Because of market forces, oxycodone has been one of the primary target opioids to be tackled in the first wave of abuse-deterrent formulations. A number of attempts have been made at extended-release (ER) formulations using different technologies, and several have been successful in achieving FDA approval. Given this relatively crowded space, particularly for ER oxycodone formulations, this provides a useful example of critical considerations for Sponsors developing new formulations that can be extrapolated to other product opportunities. Table 1 summarizes the products currently approved in the space.

Given the results of the recent Advisory Committee meeting (here), it would appear the first immediate release (IR) oxycodone with abuse-deterrent labeling claims will be approved soon in the form of Inspirion Delivery Systems’ RoxiBond formulation. Other formulations targeting the elusive Abuse-deterrent IR opioid space appear to be close on the heels of the Inspirion product.

Differentiation Is the Key to Success

Setting aside patent protection issues for new product developers, it would appear that the Agency’s view of efficacy is to enable new developments within its purview provided the Sponsor’s strategy for development accommodates differentiation from existing products. As with all 505(b)(2) products, the key to success in gaining access to the market, and in maximizing market share, is to differentiate from other approved products. In the abuse-deterrent space, Sponsors have focused on differentiation from the non-abuse-deterrent formulations. However, it would appear that differentiation from other abuse-deterrent formulations may be required in the future.

The FDA has suggested (here) that part of the long-term goals of its Opioid Action Plan (here) is to replace non-abuse-deterrent opioids in the market with abuse-deterrent formulations to ensure enough options are available to address the real need for opioid analgesics. If and when that happens, it is not clear what the baseline comparator for abuse liability studies would be, but the notion would suggest that new technologies would either have to be developed as generics or demonstrate superiority over existing abuse-deterrent formulations in order to gain approval and more importantly, market success.

Knowledge and Experience Help Position for Success

All of this would suggest that the next round of abuse-deterrent products will likely have to differentiate from existing approved products to gain approval. This is going to require both a deep understanding of the current development landscape as well as a forward-looking approach to carve out a strong position in an increasingly crowded market. Drug developers are also looking to expand into more diverse (read: smaller or niche) areas of the market as the space becomes more crowded.

The developments in this area are fluid and fast-changing given the public pressure to address the ongoing opioid crisis. The Premier Consulting team works with sponsors to identify the best possible path forward for their specific technology given this constantly shifting landscape. Contact us to learn more about our deep knowledge and experience in developing abuse-deterrent opioid drug products using the 505(b)(2) regulatory pathway.